Copper's Record Rally: Why Boring Management Matters More Than Ever for Water Utilities

Copper's Record Rally: Why Boring Management Matters More Than Ever for Water Utilities

E-Score Water | February 2026 | Finance & Operations

Copper prices have surged 40% over the past year, hitting record highs above $13,000 per tonne on the London Metal Exchange. For water utilities facing EPA-mandated lead service line replacements and aging infrastructure, this commodity spike couldn't come at a worse time. Yet the utilities that will weather this storm aren't those with the largest capital budgets—they're those with systematic operational protocols that maximize the value of every dollar spent.

The Perfect Storm: Record Prices Meet Regulatory Mandates

The copper market has been transformed by a confluence of factors that shows no signs of abating. U.S. tariff uncertainty has driven stockpiling that pulled global supplies to the Americas. AI data centers—each consuming up to 50,000 tons of copper—have created voracious new demand. Meanwhile, mine disruptions in Chile, Peru, and Indonesia have constrained supply precisely when the energy transition requires exponentially more of the red metal.

Copper Price Trajectory: November 2025 – February 2026

| Period | LME Price ($/tonne) | Change from Baseline | Key Driver |

|---|---|---|---|

| Nov 2025 | $11,000 | Baseline | Pre-rally baseline |

| Dec 2025 | $12,000+ | +9% | Record high breached |

| Jan 2026 | $13,387 | +22% | New all-time high |

| YoY Change | — | +40-42% | Best year since 2009 |

Source: London Metal Exchange, Goldman Sachs Research, CNBC market data

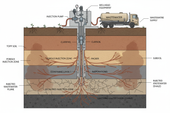

This pricing environment collides directly with the EPA's Lead and Copper Rule Improvements (LCRI), which took effect in December 2024. The mandate is unambiguous: water systems must replace all lead service lines within 10 years, with the lead action level lowered from 15 µg/L to 10 µg/L starting November 2027. The EPA estimates 4-9 million lead service lines remain in service nationwide, with replacement costs ranging from $45 billion to $90 billion.

Copper Price Surge: LME Prices ($/tonne)

The Math That Doesn't Work Without Operational Excellence

Consider the economics facing a mid-sized utility serving 50,000 connections. At current copper prices, a standard 65-foot copper service line costs approximately $286 in materials alone—up 15% from 2025 averages. With installation, total replacement costs range from $5,000 to $10,000 per line. For a utility with 2,000 lead service lines, the material cost increase alone adds $86,000 to $172,000 to the project—and that's before accounting for labor inflation, supply chain constraints, and competitive bidding pressures.

Service Line Replacement: Cost Impact Analysis

| Component | 2024 Baseline | 2026 (Current) |

|---|---|---|

| Copper pipe (65 ft) | $248 | $286 |

| Full installation | $4,500 | $5,000-$5,500 |

| Copper wire/cable (YoY) | Baseline | +22% |

Sources: Copper Development Association, ABC Producer Price Index analysis, industry estimates

The federal Bipartisan Infrastructure Law allocated $15 billion for lead service line replacement, with $9 billion distributed to date—enough to replace an estimated 1.7 million pipes. But with 4-9 million lines requiring replacement, the funding gap is staggering. Estimates suggest $45-90 billion in total costs, meaning the remaining $6 billion in federal funds covers less than 10% of need. The remainder falls to ratepayers.

Why Operational Excellence Determines Who Survives

Here's the uncomfortable truth that commodity price spikes reveal: utilities with systematic operational protocols stretch every capital dollar further than those relying on heroic technology purchases or reactive maintenance. When copper prices rise 22% in two months, the utilities that have invested in inventory protocols, lifecycle cost analysis, and strategic procurement weather the storm. Those that haven't face budget overruns, project delays, and rate increases that strain affordability.

The Operational Excellence Advantage

- Strategic Material Procurement: Utilities with systematic procurement protocols locked in copper supplies during Q3 2025, before the November surge. Those without protocols are now paying spot prices 22% higher.

- Lifecycle Cost Analysis: While plastic pipe costs $46 per service line versus $286 for copper, utilities with robust asset management understand that copper's 50+ year lifespan and lower maintenance requirements often deliver superior total cost of ownership. The operational discipline to make these calculations—rather than chasing lowest upfront cost—separates excellent utilities from struggling ones.

- Inventory Accuracy: The EPA's revised lead service line estimate—dropping from 9 million to 4 million—reflects improved inventory data. Utilities that invested in systematic service line identification can plan and budget accurately. Those with unknown service line materials face both compliance risk and cost uncertainty.

- Non-Revenue Water Reduction: The U.S. loses 2 trillion gallons of treated water annually through leaks—$6.4 billion in preventable costs. Utilities achieving 15-20% water loss rates through systematic protocols have more capital available for mandatory replacements than those hemorrhaging 30-40% of their product.

The Rate Shock Reality

U.S. water and sewer bills have increased 24% over five years, with some cities now exceeding the EPA's 4.5% affordability threshold relative to median household income. In Birmingham and Cleveland, water bills now consume a higher percentage of household income than federal guidelines consider sustainable. This commodity-driven cost pressure compounds existing challenges from aging infrastructure and regulatory compliance.

Construction input costs for copper wire and cable jumped 22% year-over-year in 2025, with analysts projecting further increases if tariffs remain in place. For water utilities, this isn't an abstract market statistic—it's the difference between meeting regulatory deadlines and requesting deadline extensions, between manageable rate increases and affordability crises.

What Excellence Looks Like in a High-Cost Environment

The utilities that will thrive despite copper's record prices share common operational characteristics:

- Data-Driven Asset Management: They know exactly what they have, where it is, and what condition it's in. The ASCE's 2025 Infrastructure Report Card emphasizes that asset management plans are the cornerstone of effective utility management—yet many small utilities lack adequate plans or fail to use them effectively.

- Systematic Procurement: They use commodity price intelligence to time purchases, maintain buffer inventories, and leverage bulk purchasing arrangements. They don't buy copper at peak spot prices because they planned ahead.

- Integrated Capital and Operations Planning: They understand that the $200,000 investment in systematic protocols determines whether the $50 million infrastructure upgrade delivers consistent performance or underperforms expectations.

- Resilience-First Thinking: They build flexibility into their systems—multiple material options, staggered procurement schedules, and contingency reserves—so that commodity shocks don't derail capital programs.

The Path Forward: Boring Management Beats Heroic Technology

Goldman Sachs forecasts copper prices declining to $11,000 per tonne by year-end as tariff uncertainty resolves and global surplus conditions reassert themselves. J.P. Morgan projects $12,500 per tonne in Q2 2026 before gradual moderation. But waiting for lower prices isn't a strategy—it's hope disguised as planning.

The utilities that will meet their Lead and Copper Rule Improvements deadlines without breaking ratepayer budgets are those investing now in the operational fundamentals: accurate inventories, systematic procurement, lifecycle cost analysis, and integrated planning. These aren't glamorous technology purchases that make headlines. They're the boring management fundamentals that deliver 400-800% ROI compared to 50-200% for capital projects alone.

Copper prices will fluctuate. Regulatory requirements will tighten. Federal funding will remain inadequate. The utilities that survive and thrive will be those that have built the operational infrastructure to maximize every dollar—regardless of what commodities markets do.

The Bottom Line: Copper's 40% rally isn't a crisis for utilities with systematic operational protocols—it's a stress test that validates their investments in boring management fundamentals. For utilities without these protocols, the same price spike becomes a budget-breaking emergency that delays compliance and burdens ratepayers. The choice between these futures is made today, in decisions about operational investment that rarely make headlines but always determine outcomes.

Key Takeaways for Utility Leaders

- Copper prices hit $13,387/tonne in January 2026—up 22% from November and 40%+ year-over-year

- EPA's LCRI mandates all lead service line replacement within 10 years, affecting 4-9 million pipes nationally

- Replacement costs: $45-90 billion nationally; federal funding covers less than 20% of need

- Utilities with systematic operational protocols can reduce effective costs 15-25% through strategic procurement and lifecycle analysis

- Operational excellence investments deliver 400-800% ROI versus 50-200% for capital projects alone