The $7 Trillion Water Financing Challenge That Could Make or Break Global Economic Growth

Water is everywhere, yet nowhere in our investment portfolios. Despite being the foundation of nearly every economic activity—from agriculture to data centers—water infrastructure remains chronically underfunded while demand soars and climate risks intensify.

This paradox came into sharp focus during a recent high-level workshop in Geneva, where over 30 water sector leaders gathered to tackle a pressing question: How do we unlock the investment needed to build resilient water systems for the future?

The $7 Trillion Blind Spot

The numbers are staggering. According to the World Bank, there's a $7 trillion investment gap in water infrastructure globally. Yet water firms consistently rank low in revenue and market capitalization compared to other essential industries. OECD data reveals that water tariffs cover only 70% of service costs, leaving taxpayers to fill the gap.

Meanwhile, blended finance for water and sanitation represents just 5% of transaction volume and under 1.5% of mobilized commercial finance. This chronic underinvestment persists despite water being critical to health, climate resilience, and economic prosperity.

The disconnect is striking: water supports everything from agriculture to energy to digital infrastructure, but remains largely invisible in global investment strategies.

From Risk to Opportunity: Reframing Water as a Strategic Asset

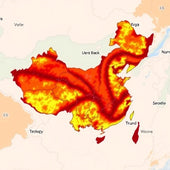

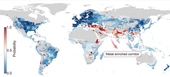

Water scarcity is rapidly becoming a geopolitical flashpoint. When demand exceeds supply, competition intensifies over transboundary rivers, reservoirs, and aquifers, adding pressure to already fragile regions. But there's another side to this story.

When managed equitably and transparently, water access becomes a powerful catalyst for socioeconomic growth, cooperation, and peace-building. The key lies in shifting our perspective from viewing water as merely an environmental issue to recognizing it as a strategic asset worthy of investment.

Each dollar invested in water infrastructure yields at least $2.50 in economic output, stimulating sectors like construction, services, and manufacturing. Socially, water infrastructure is a job creator, generating more than 16 jobs per $1 million invested. These aren't just environmental benefits—they're compelling economic returns.

Three Game-Changing Strategies

1. Make the Case for Urgency

Traditional government spending flows to "urgent needs," but water rarely receives that designation despite its foundational role. This must change. Water leaders need to reframe their narrative, emphasizing the immediate socioeconomic impact and competitive advantages that come with robust water infrastructure.

The paradox is clear: water supports nearly all industries but lacks the crisis framing that drives rapid fund allocation. Making the case for urgency around water resilience is now a critical first step to closing the investment gap.

2. Define the Market and Expand the Players

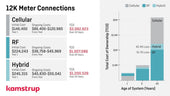

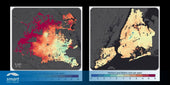

The water sector is evolving beyond traditional boundaries. From decentralized circular water solutions for real estate to AI-optimized cooling systems, water is becoming a lever of competitiveness for non-traditional players.

Collaborations are already emerging: Ecolab partnering with Microsoft for enhanced water data visibility, and Acea working with Intesa Sanpaolo on infrastructure financing and talent development. The multi-utility model—where companies manage water, energy, and gas services under one structure—offers compelling opportunities to drive cross-sector synergies and boost access to capital.

These partnerships highlight a growing reality: collaboration between traditional water companies and non-water actors can unlock innovative business models and attract new sources of capital.

3. Establish Global Best Practices

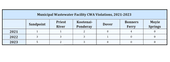

Without reliable data on water consumption, particularly for industrial and agricultural use, policymakers struggle to create data-driven frameworks for water resilience. Companies in the water value chain must take the lead in identifying and sharing global best practices while developing bankable projects that promote standardized business models.

By reducing ambiguity and fragmentation in the sector, industry leaders can guide policymaking, modernize regulatory frameworks, and establish more predictable conditions for investment. This includes creating dedicated financial instruments tailored to the specific risks, timelines, and returns of water infrastructure projects.

A New Narrative for Water Investment

The Geneva workshop marked a critical turning point in rethinking water systems. With the right approach, the water sector can shift from being an overlooked enabler to a key driver of sustainable growth, innovation, and resilience across the broader economy.

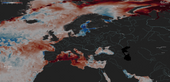

The urgency is undeniable. Climate change, aging infrastructure, and rising demand are converging to create both unprecedented challenges and extraordinary opportunities. The question isn't whether we can afford to invest in water infrastructure—it's whether we can afford not to.

For investors, policymakers, and business leaders, the message is clear: water infrastructure isn't just about environmental stewardship anymore. It's about economic competitiveness, geopolitical stability, and sustainable growth in an increasingly water-stressed world.

The $7 trillion investment gap represents more than a challenge—it's perhaps the greatest untapped opportunity of our time. Those who recognize water as the strategic asset it truly is will be the ones shaping the economy of tomorrow.