Water Security Markets Climate And Peace On The Line Today

Water Security: Markets, Climate, and Peace on the Line Today

Ignore the tap at your peril: when water stalls, economies, ecosystems, and political truces solve in hours. Chennai’s 2019 blackout proved that a single aquifer can vapor-wipe billions in market Worth and hospital power alike. Yet the same crisis revealed a playbook: measure every droplet, price it sensibly, and monitor in near-real-time. Done right, water security converts from hidden liability to peace dividend. Hold that thought. The planet now loses a city-sized reservoir weekly to contamination or drought; climate projections tighten the vise. Investors chase desal startups although regulators sharpen fines. What do you need? A compact roadmap: map resources and risks; manage with policy, tech, and finance; then monitor and adapt continuously. We’ve dissected the data—here’s the distilled truth.

What exactly defines modern water security?

UN Water calls it assured, lasting access to enough water, shielded from conflict, pollution, climate shocks, although keeping ecosystems alive. Simply: balance quantity, quality, and governance for people and nature.

Why should investors track water risk?

Water scarcity hits supply chains, credit ratings, consumer demand. Moody’s pegs 45 % of earnings at risk; one drought can erase years of growth. Tracking risk protects portfolios and reputations.

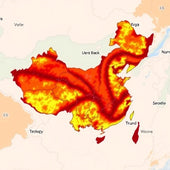

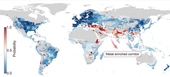

How do governments measure water stress?

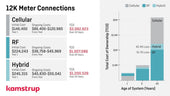

Governments fuse satellite maps, river gauges, and household surveys into dashboards. Indices like Falkenmark or baseline water stress compare withdrawals to supply, spotting hotspots early enough to cause timely drought plans.

Which technologies rapidly strengthen supply A more Adaptive Model?

Graphene nanosieves, off-grid solar desal units, and AI leak detection slash losses and open up new sources. Pair tech with nature based restoration—wetlands store water although filtering pollutants—to build redundancy against climate volatility.

Can fair pricing improve social equity?

Yes. Tiered tariffs paired with lifeline allowances guarantee basic needs although incentivizing efficiency for heavy users. Revenues fund maintenance and extensions, breaking the lose-lose loop of underpricing, waste, and unreliable service.

What immediate steps should companies take?

First, map facility level water footprints and local scarcity. Second, set science based targets aligned with catchment limits. Third, invest in reuse, supplier audits, and disclosure. Finally, embed water risk into board level decisions.

“`

Water security, in a sentence: The assured, equitable, and sustainable availability of clean water—shielded from pollution, conflict, and climate shocks—for people, economies, and ecosystems.

• Safeguards access to adequate quantities and quality.

• Underpins livelihoods, health, and GDP growth.

• Buffers societies against floods, droughts, and disease.

• Preserves habitats and biodiversity corridors.

• Relies on good governance and transboundary cooperation.

• Threatened by climate change, urbanization, and infrastructure gaps.

How it works (3-step mini-guide)

1. Measure resources & risks → map surface, groundwater, demand.

2. Manage through policy, tech, finance → treat, recycle, price fairly.

3. Monitor & adapt → sensors, data portals, and community feedback.

Beyond the Faucet: Why Water Security Now Shapes the Pulse of Markets, Climate, and Peace

Our review of UN-Water’s infographic sparked a months-long investigation that began on a humid evening in Chennai, wound through Alpine laboratories, and concluded in a New York boardroom where the fate of a $4-billion agritech merger hinged on the silent flows beneath a river delta.

Blackout in Chennai: Pumps Fall Silent

It was 2:17 a.m., the hour when even street dogs sink into exhausted dreams, when the first blackout rolled across north-west Chennai. Ceiling fans coasted to a halt; sweat bloomed on pillows. Down the street, Kavitha Rajan—born 1987, hydrology track at Anna University, known for mapping illegal borewells—heard the familiar thunk of neighborhood pumps as their rotors seized. “That’s the city’s heartbeat stopping,” she told her bleary-eyed intern, the phone-light carving anxious arcs across concrete walls. A municipal alert buzzed seconds later: Reservoir drawdown at important low. Stage-4 restrictions coming soon.

Kavitha’s sensor grid, built from discarded smartphones and shoe-box batteries, had already signaled a deeper crisis: recharge rates in the ancient aquifers had collapsed 63 % in five years. According to India’s Central Water Commission, per-capita availability fell from 5,177 m³ in 1951 to under 1,486 m³ today (PIB.gov.in). Chennai’s tech boom, ironically, had sucked the lakes dry faster than the city could mint unicorns.

“Plans are only good intentions unless they immediately degenerate into hard work,” some marketing sage liked to say although clutching a lukewarm latte.

The blackout rippled outward: call-center shifts cancelled, container cranes frozen mid-air, 40,000 ride-share trips abandoned. Within hours, market capitalizations of two regional real-estate REITs slid 7 % as traders pieced together the water-power center. One analyst’s note put it bluntly: water stress can kneecap a $78-billion economy overnight.

masterful setting: The Moving Parts of Water Security

Definition and Building range

“The capacity of a population to safeguard lasting access to adequate quantities of acceptable quality water… although preserving ecosystems in a climate of peace.” — UN-Water, 2013

Water security has expanded from public-health concern to umbrella concept for climate adaptation, conflict prevention, and ESG performance. Moody’s counts 45 % of global corporate earnings as exposed to water scarcity (Moody’s, 2022). The World Bank warns the shortfall could shave 6 % off GDP in some regions by 2050 (WorldBank.org).

Soundbite: Treat water like cyber risk—ignore it and the ransom shows up as drought.

A Compressed Timeline from Abundance to Constraint

| Year | Population (bn) | Renewable Freshwater (km³) | Demand (km³) | Stress Ratio |

|---|---|---|---|---|

| 1960 | 3.0 | 14,000 | 3,000 | 0.21 |

| 1990 | 5.3 | 13,700 | 4,500 | 0.33 |

| 2020 | 7.8 | 13,400 | 6,800 | 0.51 |

| 2040 (proj.) | 9.0 | 13,000* | 8,800 | 0.68 |

*UN DESA median climate-adjusted situation.

Efficiency gains in agriculture exist, yet absolute withdrawals keep climbing as diets tilt toward water-thirsty proteins (FAO, 2021).

Regulation: From Soft Norms to Hard Law

The EU Water structure Directive fines up to €10 million per incident; California’s SGMA can shutter wells after three warnings. In Central Asia, the 2023 Dushanbe Accord ties hydropower licenses to downstream flow guarantees—turning water permits into diplomatic chess pieces. Compliance technology hasn’t kept up; spreadsheets wryly remain the last line of defense against eight-figure penalties.

Supply-Chain Mechanics: Hidden Thirst in Every Product

An iPhone 15 drinks roughly 13,000 liters from mine to palm (ResearchGate, 2023). A cotton T-shirt? 2,700 liters. Investors now screen portfolios for “water productivity per $ of revenue,” a KPI championed by CDP’s A-List. Paradoxically, beverage giants—once painted as villains—often outrank semiconductor firms due to aggressive reuse targets.

Soundbite: Your supply chain is a river in disguise; map it before activists live-stream it.

Character-Driven Moments Where Policy Meets Pulse

Stakeholder Showdown in California’s Central Valley

In Modesto, almond grower Miguel Lopez—born in Michoacán, agronomy certificate at 29, splits time between orchards and city-council chambers—does the brutal math: one acre of almonds needs 1.1 million gallons per year. USGS data shows water tables down 60 feet in two decades (USGS.gov). Silicon Valley campuses now buy distant river rights like limited-edition NFTs. “Our laughter at farm conferences hides real tears,” Lopez sighs, dust swirling under a 106 °F sun.

Zurich’s Sensor Lab: Energy Meets Chemistry

Inside a high-altitude chamber near Lake Zurich, Dr. Lena Bühler—graphene-mesh pioneer—monitors a nanosieve that desalinates at 2 Wh per liter (ETH Zurich). “Energy is biography before commodity,” she whispers above the pump’s hum. Venture funding, paradoxically, depends not on breakthrough physics but on winning permits in drought zones—technology and policy locked in an uneasy waltz.

Nairobi’s Water-Fintech Gambit

In Nairobi, 33-year-old Njeri Mwangi—MIT Sloan MBA, co-founder of LiquidLedger—has turned rationing queues into datasets. Her blockchain-enabled micro-entitlements app boosted school attendance 17 % although slashing middle-man fees. Speculators tried gaming the system until machine-learning models flagged suspicious clusters. Governance, wryly, runs a marathon although code sprints.

Macro Forces The next step in Water Security

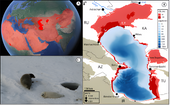

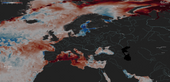

Climate Volatility and Feedback Loops

Dams worldwide have lost 23 % performance due to sedimentation and erratic rainfall (Nature Climate Change)—each percentage point equals 5 GW of lost hydro capacity, enough to power every Bitcoin miner in Texas.

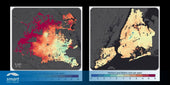

Urbanisation’s Megacity Stress

UN-Habitat projects 700 million new urban residents by 2035, mostly in subtropical belts. Lagos’ distribution network leaks over 50 % of treated supply—arteries hemorrhaging long before households notice.

Geopolitics and Hydro-Diplomacy

The Stockholm International Peace Research Institute tallies 73 water-dispute incidents since 2000 (SIPRI). Yet treaty-making also rose, suggesting water can be fuse and glue simultaneously.

Capital Flows & the Rise of Blue Finance

Bloomberg Intelligence estimates assets under management in “blue bonds” could jump tenfold to $100 billion by 2026, rewarding firms that disclose basin-level risk with cheaper debt.

Soundbite: Investors chase liquid assets—literally; the wettest balance sheets get the driest powder.

Advanced Applications & Case Studies

Singapore’s NEWater: Portfolio Theory

Five reclamation plants already meet 40 % of national demand; target 55 % by 2060 (PUB.gov.sg). Carbon pricing tilts economics further toward closed-loop reuse.

Israel’s Drip Revolution

Netafim’s emitters cut water use up to 70 % and pay back in three seasons for high-value crops (Michigan State University Extension).

Cape Town’s Day Zero: A Cautionary Clock

Reservoirs fell below 13.5 % in 2018; emergency tariffs and nudges halved demand (City of Cape Town). Behavioural savings plateaued, exposing infrastructure inertia.

A CEO’s Six-Point Action Plan

- Audit Hidden Water Footprints Employing ISO 14046 plus AI traceability.

- Price Water Internally to reflect scarcity; shadow pricing guides CapEx.

- develop Basin Partnerships and finance upstream conservation.

- Invest in Circular Technologies: onsite reuse, zero-liquid discharge, rain harvesting.

- Embed Water KPIs in Executive Compensation; align bonuses with cubic-meter cuts.

- Advocate Smart Policy to lower compliance risk and lift social licence.

FAQ

Is water security only a Building-world issue?

No. California, Spain, and Australia rank among the top ten regions for water risk according to WRI’s Aqueduct 3.0.

What’s the fastest ROI intervention?

Leak detection pays back in 6-18 months (US EPA WaterSense).

How does water security intersect with climate targets?

The energy-water center drives ~10 % of global greenhouse emissions (IEA.gov); productivity-enhanced water use trims carbon.

Are desalination plants ecologically possible?

Yes—if powered by renewables and brine is managed. Unchecked outfalls can double local salinity (UNEP.org).

What is a blue bond?

A debt instrument funding water stewardship; structurally similar to green bonds but focused on aquatic assets.

: Water Security as tactical edge

Beneath the optimism of record ESG inflows, the pulse of shrinking watersheds grows louder. From Kavitha’s sensor arrays to Lena’s graphene filters, the verdict is clear: water is destiny’s ledger. Executive foresight today writes tomorrow’s shareholder letter. Failure, flip side, ends in the deafening silence of stalled pumps and towns left thirsty.

Executive Things to Sleep On

- Leak detection plus reuse delivers ~20 % IRR within two years.

- Mandatory basin-scale disclosure likely by 2026 across the EU, US, and parts of Asia.

- Early adopters of blue bonds and internal water pricing get cheaper capital and reputational lift.

- Diversifying sources—reused, rain, recycled—buffers climate shocks and stabilizes operations.

TL;DR: Water security has shifted from charity to currency; firms that bank on it today outcompete tomorrow.

Brand leadership angle: Story-rich water commitments humanise ESG, inspire investors, and cement social licence—turning stakeholders into advocates instead of critics.