Flowing forward: Emerging opportunities in the global water sector

Despite the challenges facing the water sector, optimism is building and respondents have identified significant opportunities for growth and innovation. At the forefront is technological advancement, including desalination technology and smart water management, with 92 percent of respondents recognizing it as a significant or very significant opportunity. More than 60 percent of the respondents recognized AI’s transformative potential for the sector. Confidence is particularly pronounced among technology providers (75 percent), multinational corporations (74 percent) and water utilities (65 percent) that see AI-driven solutions as the key to addressing the sector’s most pressing challenges.

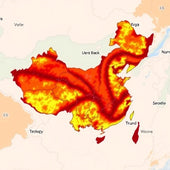

The global landscape of water innovation reveals an interesting geographic pattern, with respondents expecting new generation technologies to emerge primarily from the United States (85 percent) and Western Europe, including the UK (75 percent), Germany (66 percent) and France (50 percent). However, innovation hubs in Asia are also gaining recognition. China (55 percent) and Japan (54 percent) are expected to contribute significantly to technological advancements. Countries experiencing severe water stress, particularly in the Middle East and Asia-Pacific regions, are increasingly viewed as potential sources of innovative solutions, reflecting how local challenges can generate global solutions.

Further, the growing urgency to build climate resiliency may increase engagement with water investment. A majority (65 percent) of the respondents expect climate resiliency efforts to increase interest in water projects, while 58 percent believe it will boost the visibility of water-related issues. Moreover, 55 percent of the respondents anticipate increased capital flow into water projects, and, as a result, 40 percent foresee improved profitability. Thus, the convergence of environmental imperatives and economic opportunity is creating a compelling case for increased investment in the sector.

The integration of water management into ESG frameworks represents another significant opportunity, with nearly 90 percent of respondents believing water stewardship should play a more vital role in ESG reporting. Three-quarters of the respondents have already incorporated water strategies into their ESG strategies, although their approaches differ. While 81 percent include water as part of their overall sustainability strategy, multinational corporations (29 percent) and water utilities (25 percent) are more likely to have dedicated water strategies. As investment priorities shift to reflect these sustainability imperatives, respondents across the spectrum are positioning themselves to capitalize on increasing support for water-focused investment opportunities, with 40 percent viewing these opportunities as their top priority for 2025, followed by portfolio growth (33 percent) and digitalization and AI implementation (31 percent).

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP