Brazil’s water revolution: the rise of the world’s largest sanitation market

Brazil is rewriting its water story. Long marked by uneven access and chronic underinvestment, the country is now at the centre of one of the most ambitious transformations in the global water sector — a shift that is attracting worldwide attention and billions in investment.

The challenge is monumental. More than 33 million Brazilians still lack access to safe water, and 80 million live without sewage treatment. In total, half of the population is excluded from safely managed sanitation. To meet its goal of universal access by 2033, Brazil must double its current investment pace, deploying around BRL 550 billion (USD 100 billion) over the next decade. These investments go far beyond pipes and treatment plants — they represent a structural shift toward a more inclusive, resilient, and sustainable model of development. For a nation that holds 12% of the world’s freshwater resources, ensuring that this wealth reaches every home has become a matter of national priority.

Brazil’s sanitation journey is far from over, but its trajectory is clear: becoming a global benchmark for sustainable infrastructure

The turning point came with the New Legal Framework for Sanitation, approved in 2020. This reform broke a century of public-sector monopoly, opening the market to private participation under strict regulatory oversight. It established clear national targets — 99% water coverage and 90% sewage treatment by 2033 — and created a transparent, competitive environment that has already reshaped the landscape. By providing legal and tariff stability, the framework gave both domestic and foreign investors the long-term confidence that had long been missing.

The results speak for themselves. Private participation has surged from 13% in 2012 to 42% in 2024, driven by landmark transactions such as the full or partial privatizations of state-owned utilities like CEDAE, Corsan, and Sabesp. These operations, alongside new concessions in northern states such as Pará, have signalled growing investor confidence and demonstrated that large-scale transformation is possible.

Initially, Brazilian companies led this process, leveraging their local expertise and deep understanding of complex regulations. They often attracted international capital, with funds such as GIC and Brookfield joining their equity. More recently, major global utilities have entered the scene. The next phase will likely bring further mergers and acquisitions, new regional operators, and increasing technological partnerships as the market consolidates and matures.

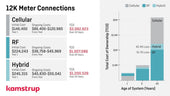

Beyond concessions, Brazil’s water revolution extends across the entire value chain. Construction and engineering demand will soar as networks expand to underserved regions. Operations and maintenance contracts offer recurring, capital-light business models. Utilities are investing in renewable energy, while digitalisation is transforming efficiency through smart meters, AI-driven monitoring, and real-time leakage detection. Integrating these innovations is reducing costs, cutting emissions, and helping utilities manage resources with unprecedented precision.

The opportunities are vast, but not without complexity. Regional disparities in income and tariff structures require nuanced approaches, and environmental regulations are becoming more stringent. The North and Northeast, though more challenging, hold the greatest potential for impact — where investments can change lives, strengthen local governance, and foster inclusive economic growth. For international investors, success will depend on long-term commitment, reliable local partnerships, and the capacity to adapt to Brazil’s social and geographic diversity.

Brazil’s sanitation journey is far from over, but its trajectory is clear: a once-stagnant sector is becoming a global benchmark for sustainable infrastructure investment. As billions flow into projects that bring clean water and dignity to millions, Brazil is proving that transformation on this scale is not only possible — it is already well underway.