Three Water Markets, Three Pricing Philosophies: Why Operational Frameworks Matter More Than the Price Tag

Three Water Markets, Three Pricing Philosophies: Why Operational Frameworks Matter More Than the Price Tag

Comparing water pricing structures in Australia's Murray-Darling Basin, California, and Alberta reveals a universal truth: without systematic operational protocols, even the most sophisticated market mechanisms fail to deliver reliable water service.

The Price of Water Is Not the Cost of Water

When the Nasdaq Veles California Water Index (NQH2O) closed at $312.50 per acre-foot in late December 2025, it told a deceptively simple story: California water rights were trading at their lowest level in years, down dramatically from the drought-driven peaks above $1,100 per acre-foot in 2022. But that single number — broadcast globally via the world's first exchange-traded water price benchmark — obscures more than it reveals about what water actually costs to deliver reliably to homes, farms, and businesses.

Halfway around the world, temporary water allocations in Australia's Murray-Darling Basin (MDB) reached $300 per megalitre in some systems by the close of the 2024–25 water year, driven by drought conditions and government buyback programs. And in Alberta, Canada, where the South Saskatchewan River Basin has been closed to new surface water licences since 2006, a 130-year-old priority system continues to determine who gets water in times of scarcity — with no formal price signal at all.

These three jurisdictions represent three fundamentally different approaches to valuing water. Each tells a story not just about pricing, but about the operational frameworks — or lack thereof — that determine whether water infrastructure investments actually deliver consistent, reliable service. As the E-Score Water thesis holds: boring management beats heroic technology, every time.

California: The Financialized Water Market

How the NQH2O Index Works

Launched in October 2018 at a value of $371.11 per acre-foot, the NQH2O tracks the volume-weighted average price of water rights transactions — both leases and sales — across California's five largest and most actively traded water regions: the state's surface water market and four adjudicated groundwater basins (Central Basin, Chino Basin, Main San Gabriel Basin, and Mojave Basin Alto Subarea). Between 2012 and 2019, these markets alone represented approximately $2.6 billion in transactional activity.

The index is published weekly on Wednesdays, reflecting the prior week's transactions as compiled by WestWater Research's Waterlitix database. Since December 2020, CME Group has offered financially settled futures contracts based on NQH2O, allowing farmers, municipalities, and funds to hedge against water price volatility with contracts sized at 10 acre-feet each.

The Price Disparity Problem

What the NQH2O doesn't capture is the extraordinary disparity in what different types of water users actually pay. A December 2025 UCLA/NRDC study found that California cities pay an average of $722 per acre-foot of surface water — roughly 20 times the average $36 per acre-foot paid by agricultural water districts. Five major agricultural suppliers paid nothing to the federal government for nearly 4 million acre-feet of water, including three Colorado River recipients: the Imperial Irrigation District, Coachella Valley Water District, and Palo Verde Irrigation District.

(High End)

(Dec 2025)

Average

(IID, CVWD, PVID)

Meanwhile, individual irrigation districts operate with wildly different rate structures. Central California Irrigation District charges a three-tiered system ranging from $18 per acre-foot (Tier 1, up to 3.2 AF/gross acre) to $110 per acre-foot (Tier 3, for purchased supplemental water). Los Angeles DWP residential customers face tiered volumetric rates adjusted by temperature zone and lot size. The true price of delivered water is layered beneath conveyance costs, treatment costs, infrastructure debt service, and distribution system maintenance — none of which the NQH2O benchmark captures.

The E-Score Takeaway: California has the world's most transparent raw water pricing mechanism, yet the $1.1 billion annual market tells you nothing about whether the utility delivering that water to your tap operates with systematic loss-reduction protocols, asset management frameworks, or demand forecasting systems. A sophisticated financial instrument layered atop fragmented operational management is still fragmented operational management.

Murray-Darling Basin: The Allocation Trading System

Entitlements, Allocations, and a Two-Speed Market

Australia's Murray-Darling Basin encompasses over one million square kilometres and contributes more than $22 billion annually to the national economy through agriculture. The Basin Plan, passed into Commonwealth legislation in 2012 and amended in 2017–18 and 2023, created the world's most comprehensive water trading framework — distinguishing between permanent entitlements (the right to access a share of water in perpetuity) and temporary allocations (the right to use a specific volume in a given water year).

The 2024–25 water year revealed a market under pressure. The Ricardo Water Markets Report documented that the annual volume-weighted average price for temporary allocations across the southern MDB was $153 per megalitre (AUD), with prices reaching as high as $300 per ML in some systems by year's end. This represented the first annual increase in allocation prices since 2018–19, driven by below-average rainfall, reduced allocations, and record drawdown on storage.

Permanent entitlement markets told a different story. The Ricardo Entitlement Index (REI) increased 5.7% annually — the first positive growth in three years — largely driven by the Australian Commonwealth's resumption of water buybacks to meet Basin Plan environmental targets. The government's Restoring Our Rivers program, which commenced purchasing in July 2024, paid an average of $4,980 per megalitre across all catchments and entitlement types in its strategic purchasing rounds. Individual catchment prices varied enormously, from $774 per ML for NSW Border Rivers entitlements to $7,692 per ML in the Condamine Balonne system.

The Scale of the Framework

What makes the MDB system distinctive is its institutional architecture. Five state governments, the Commonwealth, the Murray-Darling Basin Authority, irrigation corporations, and thousands of individual entitlement holders interact within a framework of water-sharing plans, sustainable diversion limits, carryover rules, and inter-valley trade restrictions. The 2023 Restoring Our Rivers Act extended Basin Plan deadlines and enabled additional Commonwealth water purchases — removing previous protections that required "neutral socio-economic outcomes" from buybacks. Victoria has refused to sign onto these changes but cannot prevent them from proceeding.

The Operational Gap: For all its regulatory sophistication, the MDB system still faces a fundamental challenge: water entitlements dropped $1.9 billion in value in the 2023–24 financial year alone. Average allocation prices of $76/ML that year fell far short of the long-term average of $166/ML. This volatility isn't a market failure — it's the system working as designed. But it does mean that utilities and irrigators without systematic water-portfolio management protocols are perpetually reactive rather than strategic.

Alberta: The Seniority-Based Licence System

First in Time, First in Right

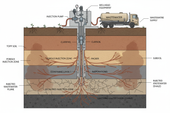

Alberta operates under a water allocation philosophy that dates to 1894: the "first in time, first in right" (FITFIR) priority system. All water in the province is vested in the Crown, and the roughly 25,000 water licences that have been issued grant diversion rights ranked by their application date. In times of shortage, a licensee from 1894 has the absolute right to their full allocation before a licensee from 2004 receives a single drop.

The system has been tested. The South Saskatchewan River Basin — encompassing the Bow, Oldman, and South Saskatchewan River sub-basins that serve much of southern Alberta, including Calgary — has been closed to new surface water licences since 2006, with approximately 70–80% of natural flows already allocated. This closure created Canada's first market-based water transfer system, allowing existing licensees in the SSRB to voluntarily buy, sell, or trade water allocations. The province retains a 10% "holdback" on transfers, keeping that water in the natural system.

The Price That Isn't

Unlike California's indexed market or the MDB's active exchange, Alberta's water transfer market has no central pricing mechanism, no public index, and minimal price transparency. Licensees pay a one-time application fee based on volume. Transfer prices are negotiated bilaterally between willing sellers and willing buyers, with government oversight focused on environmental impact rather than price discovery.

At the retail level, Alberta municipalities charge residents directly for treated water delivery. Calgary's residential water rate structure charges per cubic metre consumed plus a fixed monthly service fee based on meter size, with the 2024 wholesale rate set at $0.8094 per cubic metre (approximately $0.998 per cubic metre inclusive of distribution costs). Edmonton's EPCOR utility operates a similar volumetric model. The city of St. Albert charges $1.85 per cubic metre. These rates cover treatment, delivery, and infrastructure maintenance — but they do not reflect the underlying scarcity value of the water right itself.

The 2024 drought exposed the system's fragility. Canada's largest irrigation district, the St. Mary River Irrigation District, told farmers they would receive half their normal allocation. The Alberta government negotiated what it called the largest voluntary water-sharing agreements in the province's history, with municipalities like Calgary agreeing to reduce consumption by 5–10%. Yet the fundamental question persists: a priority system that has "never been applied to cut off a major user" may not withstand the pressures of a growing population, expanding energy sector, and changing climate.

Head-to-Head: Three Pricing Structures Compared

| Dimension | California (NQH2O) | Murray-Darling Basin | Alberta (SSRB) |

|---|---|---|---|

| Pricing Model | Exchange-traded index ($/acre-foot) | Entitlement + allocation markets (AUD/ML) | Bilateral licence transfers; no public index |

| Current Raw Water Price | ~$312/AF (NQH2O, Dec 2025) | ~A$153/ML avg allocation; up to A$300/ML (2024–25) | No transparent benchmark; wholesale ~C$0.81/m³ |

| Entitlement / Permanent Price | Varies by basin; $100s–$1,000s/AF | Avg. ~A$4,980/ML (govt buyback price, 2023–24) | Negotiated bilaterally; no published data |

| Urban Retail Cost | ~$722/AF average (urban wholesale); tiered residential | A$2–4/kL typical residential | C$0.81–1.85/m³ residential |

| Agricultural Cost | $0–$110/AF (highly variable by district) | A$76–$300/ML allocation market | Licence-based; no per-volume charge |

| Allocation Method | Rights-based + market trading | Entitlement shares + seasonal allocation | FITFIR priority + closed-basin transfers |

| Price Transparency | High (Nasdaq weekly index, CME futures) | High (state registers, Ricardo Index) | Low (bilateral, no central exchange) |

| Futures / Hedging | Yes — CME NQH2O futures (since Dec 2020) | No formal futures market | No |

| Regulatory Body | SWRCB, DWR, CPUC (fragmented) | MDBA, ACCC, state water registers | Alberta EPA, AER (consolidated) |

| Key Vulnerability | Urban/ag price disparity; fragmented operations | Govt buyback pressure; entitlement volatility | No price signal; untested priority system |

What All Three Markets Get Wrong

The Missing Layer: Operational Protocol Frameworks

Whether water costs $312 per acre-foot on the Nasdaq, A$153 per megalitre on Australia's allocation market, or has no transparent price at all in Alberta's bilateral system, the same operational gap persists across all three jurisdictions: none of these pricing mechanisms incentivize or measure the systematic operational protocols that determine whether infrastructure investments deliver consistent performance.

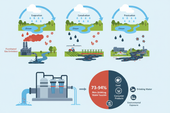

Consider the economics. Water utilities globally spend heavily on capital infrastructure — treatment plants, distribution networks, storage facilities. The emerging U.S. municipal water infrastructure forecast projects $515.4 billion in required investment through 2044. Yet research consistently demonstrates that utilities with systematic operational protocols achieve 15–20% water loss rates compared to 30–40% in utilities without structured frameworks. The return-on-investment disparity is even starker: operational excellence investments routinely deliver 400–800% ROI compared to 50–200% for capital projects alone.

Each of these three markets illustrates a different dimension of this problem. California's NQH2O gives you the price of water at the source — but a utility buying that water has no index telling it whether its distribution system loses 12% or 40% before reaching customers. The MDB's sophisticated entitlement framework creates price signals for water as a commodity — but doesn't evaluate whether the irrigation corporation delivering that allocation operates with systematic asset management, demand forecasting, or leak detection protocols. Alberta's priority system guarantees access order — but provides no mechanism for assessing whether licensees use their allocations with operational efficiency or waste.

The Universal Pattern

This pattern — overinvesting in market mechanisms and infrastructure while underinvesting in systematic operational frameworks — repeats globally. It's the same pattern that contributed to Calgary's 2024 feeder main break, where aging infrastructure without adequate inspection protocols failed catastrophically. It's the same pattern visible in Iran's groundwater depletion crisis, where massive dam construction projects proceeded without the boring-but-essential aquifer monitoring systems that would have revealed the problem decades earlier.

The through-line is consistent: boring management beats heroic technology. Whether you're looking at a California almond farmer hedging water futures on the CME, an Australian irrigator managing entitlement portfolios across the southern MDB, or an Alberta municipality navigating voluntary water-sharing agreements during drought — the common denominator of resilience is not the sophistication of the pricing mechanism. It's the presence or absence of systematic operational protocols underneath.

Implications for Water Utility Leaders

For utility CFOs and risk managers watching these three markets, the strategic takeaways are pragmatic. First, water price transparency is improving globally — the NQH2O model will eventually expand beyond California, and Australia's MDB framework provides a template for other jurisdictions. Plan for a future where your raw water costs are more visible to regulators, ratepayers, and investors.

Second, the growing gap between raw water commodity prices and retail delivery costs is where operational excellence creates the most value. Mid-sized utilities serving 25,000–100,000 people represent the highest-leverage opportunity: large enough to benefit from systematic protocols, small enough to implement them without multi-year bureaucratic approval processes.

Third, the regulatory direction in all three jurisdictions is toward greater accountability. The MDB's new Water Markets Intermediaries Code (effective July 2025) mandates trust accounts, audits, and transparency. Alberta's Auditor General flagged the province's surface water management for inadequate monitoring and unclear guidelines. California's SGMA groundwater sustainability framework continues to tighten. In all cases, the utilities best positioned are those with documented, systematic operational frameworks — not just expensive infrastructure.

The Bottom Line: The Nasdaq Veles California Water Index, the Murray-Darling Basin's allocation markets, and Alberta's FITFIR system each represent genuine innovations in water governance. But financial innovation without operational innovation is like building a stock exchange for a company that doesn't track its inventory. The price signal is only as valuable as the management system that acts on it. The utilities and districts that will thrive in the emerging era of water scarcity pricing are those that pair market literacy with systematic operational excellence — and recognize that the $200,000 protocol investment delivers more reliable outcomes than the $50 million capital project it was designed to support.

Sources & Further Reading

California / NQH2O: Nasdaq Veles California Water Index methodology (Nasdaq, 2018–present); CME Group NQH2O futures overview; WestWater Research / Waterlitix database; Pacific Institute analysis of California water futures; UCLA/NRDC water pricing study (December 2025); Central California Irrigation District rate schedules.

Murray-Darling Basin: Ricardo Water Markets Report 2024 and 2025; Aither annual water markets report 2023–24; Australian Government DCCEEW water purchasing data; Murray-Darling Basin Authority 2025 Outlook; ABARES Water Trade Model impact analysis.

Alberta: Alberta Water Act (2000); Alberta Energy Regulator water availability and allocation reports (2024); CBC News analysis of Alberta water allocation system (February 2024); Alberta Auditor General Surface Water Management Performance Audit (July 2024); Oldman Watershed Council water management resources; South Saskatchewan River Basin Water Management Plan.