The Middle East sits atop one of history's greatest financial paradoxes. Regional sovereign wealth funds control over $4 trillion in assets—more than the GDP of France or the United Kingdom—yet the MENA region struggles with 25% unemployment, chronic underinvestment in critical infrastructure, and inter-regional trade below 10%. This disconnect between available capital and regional development reveals a fundamental truth that extends far beyond the Gulf states: wealth accumulation and regional prosperity are not the same thing.

Glenn Yago's analysis of this paradox highlights a critical question for our time: How do we redirect massive pools of capital toward solving the urgent challenges facing regions, rather than simply maximizing returns in distant markets?

The Conflict Economics Trap

For decades, the Middle East has operated under what Yago calls "conflict economics"—a system where capital flows are driven by security concerns, donor dependency, and preservation of existing power structures rather than genuine economic development. The result? Investment flows to problems rather than through solutions.

Consider the numbers: Despite $4.1 trillion in regional sovereign wealth, the MENA region sees minimal cross-border investment in critical infrastructure. Inter-regional trade remains below 10%, while unemployment among youth approaches crisis levels. The demographic time bomb ticks louder each year as 3.4% annual labor force growth outpaces job creation.

This pattern isn't unique to the Middle East. Globally, we see capital concentrated in financial centers while regions rich in natural resources struggle to translate wealth into sustainable development.

The Infrastructure Gap: Water as a Case Study

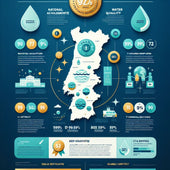

Nowhere is this paradox more evident than in water infrastructure. The MENA region faces severe water scarcity, with many countries already below the absolute water scarcity threshold of 500 cubic meters per capita per year. Climate change is intensifying droughts, groundwater depletion accelerates, and aging infrastructure loses billions of cubic meters through inefficiencies.

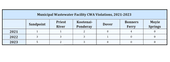

Yet despite these challenges and available capital, investment in transboundary water projects, modern irrigation systems, and wastewater treatment infrastructure remains fragmented and inadequate. The same sovereign wealth funds that invest billions in Silicon Valley tech startups struggle to channel capital into the water systems that will determine their own regions' futures.

This represents more than an economic inefficiency—it's a failure of strategic vision. Water infrastructure investments offer predictable, long-term returns while addressing existential regional challenges. They create local jobs, enable agricultural productivity, and build resilience against climate shocks. These are exactly the "win-win arrangements" that Yago identifies as essential for breaking the conflict economics cycle.

The Abraham Accords Blueprint

The Abraham Accords provide a framework for what's possible. RAND Institute research suggests that regional normalization could generate over $1 trillion in new economic activity and 5 million jobs within a decade. The proposed Abraham Fund—$3 billion from the US, $10 billion from UAE and Abraham Accord countries, matched by financial institutions—could catalyze investment in environmental, trade, energy, water, and agricultural projects.

The key insight is that sustainable projects aligned with societal goals can weave regional economies together through transboundary cooperation. Water management, renewable energy, agricultural technology—these aren't just development projects. They're the connective tissue of regional integration.

Decarbonizing with Petrodollars

Perhaps the most striking paradox: The same petrodollars that generated climate challenges could finance climate solutions. Regional sovereign wealth funds could redirect a fraction of their $4.1 trillion toward decarbonization projects, creating a sustainable economic foundation while addressing global environmental imperatives.

This isn't charity—it's strategic reinvestment. As global markets increasingly price climate risk and favor ESG-compliant investments, funds that lead in sustainable development position themselves for long-term advantage. The region that built wealth on hydrocarbon extraction has the capital to lead in renewable energy, water technology, and climate adaptation.

Beyond the Gulf: Universal Lessons

While Yago focuses on the Middle East, the paradox applies globally. Canada's oil-rich provinces accumulate wealth while struggling with infrastructure renewal. African nations with abundant natural resources see capital flight rather than domestic investment. Latin American countries rich in agricultural potential import food.

The pattern repeats: Resource wealth concentrates in sovereign funds and private hands, seeking maximum returns in global markets, while regional infrastructure deteriorates and local economies stagnate. The mechanisms differ—pension funds, sovereign wealth funds, family offices—but the outcome is consistent.

The Path Forward: Impact Capital with Teeth

Breaking this paradox requires more than good intentions. It demands:

Strategic Redirection: Sovereign wealth funds must view regional development not as charity but as core investment strategy. Long-term, stable returns from infrastructure often outperform volatile global markets while building resilience.

Transboundary Thinking: Water doesn't respect borders. Energy grids optimize through integration. Agricultural supply chains require regional coordination. Capital must follow similar logic.

Incentive Alignment: As Yago notes, we need economic processes that incentivize populations to support solutions. This means projects that create jobs, improve quality of life, and provide tangible benefits—not just financial returns to distant investors.

Speed and Scale: With climate change accelerating and youth unemployment rising, incremental approaches won't suffice. The capital exists. The challenges are clear. What's needed is decisive reallocation at scale.

Measurement That Matters: Traditional financial metrics miss the point. Return on investment must expand to include water security, employment creation, climate resilience, and regional stability. These aren't externalities—they're the actual deliverables.

The Window Is Closing

Yago's warning resonates beyond the Middle East: "Time is running out on the chance to demonstrate tangible results... Without changing facts on the ground for young people—and fast—the region will default to continued conflict over increasing scarcity."

This applies wherever resource wealth and regional challenges diverge. The paradox of abundant capital and inadequate development isn't sustainable. Either we redirect these massive pools toward building resilient, integrated regional economies, or we watch scarcity and conflict consume the gains of past resource booms.

The $4 trillion question isn't whether the capital exists to solve these challenges. It does. The question is whether we have the vision and will to deploy it strategically before the window closes.

Hope, as the saying goes, is a good breakfast but a bad dinner. It's time to move from aspirational meetings to unstoppable tides of sustainable projects that address the urgent challenges ahead. The capital is ready. The blueprint exists. What's needed now is action—before the paradox resolves itself in ways we'd all prefer to avoid.